With retail major Ascencia listed both on the Stock Exchange of Mauritius (SEM) and the SEM Sustainability Index, the capital market of Mauritius appears to be well poised for attracting global investors.

Ascencia’s dual listing on official market and SEMSI to create value

In a major move designed to boost capital markets, Mauritius’ largest retail conglomerate, the Ascencia Group, has been listed not only on the Stock Exchange of Mauritius (SEM) but also on the SEM Sustainability Index (SEMSI).

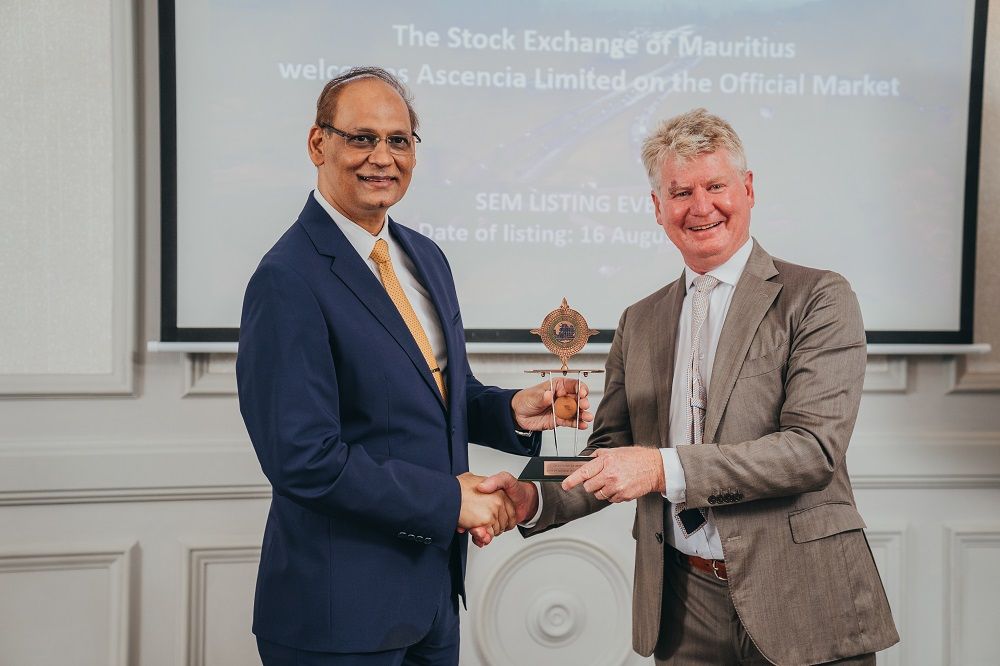

Considered a double milestone, the event pertaining to the group’s listings was held on August 16 at the Labourdonnais Hotel, Port Louis, in the presence of the Financial Services Minister, the Hon Mahen Seeruttun; the CEO of SEM, Mr. Sunil Benimadhu; and the Chairman of Ascencia, Mr. Philippe Espitalier-Noël.

Ascencia to charter path for making Mauritius a regional sustainability hub

The Minister commented: “The successful listing of Ascencia will undoubtedly help attract more development opportunities and strengthen the competitiveness of companies, together with delivering value to shareholders and investors.” He also emphasised that the listing will go a long way in making Mauritius the Sustainability Hub of Africa and spearheading ESG in the region.

On this count, Hon Seeruttun emphasised: “We have no choice but to leverage value, not just limited to finance, but also in terms of Environmental, Social and Governance (ESG) factors. Companies having solid ESG can clock in better operational performance through the concerted efforts of both Government and the private sector that will help make significant strides where such projects are assigned the highest priority by my ministry.”

He also termed Ascencia as SEMSI champions, acceding to this status following a stringent test with the organisation playing a purposeful role as part of the business equation. “SEMSI offers a robust measure of what really matters. It serves as a directory of companies that have been able to pass the ESG Impact Test, thereby, assisting social investors in their quest for responsible investment,” he added.

For his part, Group Chairman Mr. Philippe Espitalier-Noël noted that Ascencia has become the third company listed by the Rogers Group on the exchange, following Beachcomber and CIM. He underlined: “The integration of the company on the official market opens a new vista of opportunities for partnership and growth. Since its inception in 2007, Ascencia has been able to shape the retail industry by lending authentic and singular experiences with seven malls and has geared up as a true leader in the commercial real estate sector.”

He also added that the Group has always played a pro-active role in shaping opportunities for start-ups and SMEs by giving a shot in the arm to local entrepreneurs through the setting up of a framework to help develop products and services.

Finally, the Chief Executive Officer at SEM, Mr. Sunil Benimadhu, lauded the success story of the Ascencia Group, noting that the company was no stranger to challenges. Incorporated 14 years ago, it was in a span of just a year after being formed that it made the shift to going public by being listed on the Development Enterprise Market (DEM), and its eventful journey since has culminated in this dual listing on the official market and SEMSI.

He highlighted that the Group has been ranked the sixth-largest company listed on the official market since day one and is currently clocking a market cap of nearly Rs 13 billion. He further remarked: “SEMSI was launched with a market capitalisation of Rs 93.2 billion where it now stands at Rs 164 billion with Ascencia set to contribute some Rs 12.9 billion.”

Mr. Benimadhu concluded on the note that the SEM has actively engaged with the Financial Services Ministry and the BoM in coming up with a guide on sustainable bonds.